On Monday, President Obama signed the new budget bill passed by Congress last week, which includes a significant change to the claiming strategies currently available for Social Security retirement benefits. This change might adversely affect some clients who are close to retirement, but it will also slightly improve the position of the Social Security trust funds over the coming decades, which is a positive development for younger clients hoping to still receive Social Security benefits in retirement.

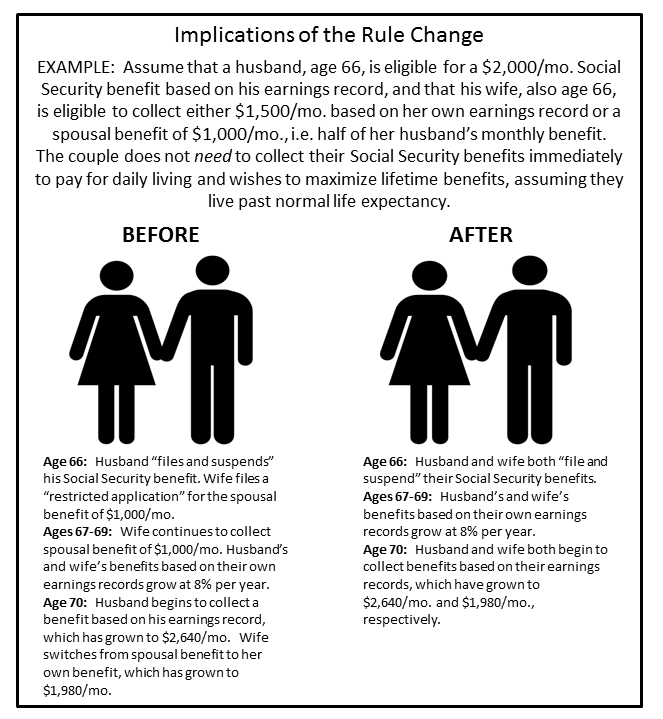

What Will Change. The bill aims to close two “loopholes” that have been available to Social Security beneficiaries since the Senior Citizens Freedom to Work Act in 2000: the ability to “file and suspend” benefits and the ability to file a “restricted application” for benefits. The “file and suspend” strategy involves one spouse, usually the higher income earner, to file for Social Security benefits and then immediately suspend payments. This enables the beneficiary’s spouse to file for spousal benefits, while still allowing the beneficiary’s own benefit to grow at 8% per year until age 70. Filing a “restricted application” allows a spouse (or ex-spouse) to collect a spousal benefit from full retirement age until age 70, and then switch to his/her own benefit, which has grown at 8% per year for the intervening years. With the provisions in the new bill, if a beneficiary suspends benefits, all payments based on his/her record will be suspended, and if a spouse (or ex-spouse) files for benefits, he/she will receive either a spousal benefit or their own benefit (whichever is higher) and will not have the option of switching to the other benefit later.

When Will It Change. The ability to “file and suspend” will end on May 2, 2016, which is 6 months from the date that President Obama signed the budget bill. The strategy of filing a “restricted application” will still be available at any time to individuals who have attained age 62 prior to 2016. Individuals who turn age 62 after 2015, however, will not be able to use this strategy.

When Will It Change. The ability to “file and suspend” will end on May 2, 2016, which is 6 months from the date that President Obama signed the budget bill. The strategy of filing a “restricted application” will still be available at any time to individuals who have attained age 62 prior to 2016. Individuals who turn age 62 after 2015, however, will not be able to use this strategy.

What You Should Do. For those over age 66, or turning 66 before May 2nd, evaluate whether the “file and suspend” strategy would benefit you and your family. For those who will be 62 or older before year end, evaluate whether filing a “restricted application” would benefit you. For those under age 62, there is nothing that you need to do now, other than to note the impact of these new rule changes on your retirement income. For many beneficiaries, these changes will result in fewer options with regard to claiming Social Security, namely deciding at what point between age 62 and age 70 to start receiving benefits.

As always, we are here to help in navigating when and how to collect Social Security benefits (and have also written a prior post on this subject). Please contact us to figure out what moves to take, based on your specific situation.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870

Notifications