Throughout the past year, as with 2014 and 2013 before that, U.S. stocks have generated higher investment returns in aggregate as compared with non-U.S. developed and emerging markets. This has generated questions among U.S. investors of whether it is necessary and/or beneficial to hold international stocks. These questions, however, are nothing new and are not specific to international, emerging markets, or any other investment asset class. Cognitive biases tend to lead investors to think that recent trends will continue and to downplay evidence to the contrary, so any time a particular asset class outperforms others for a prolonged period of time, questions about the benefits of diversification arise. However, taking a step back and evaluating long-term trends helps confirm our belief that diversification improves investment results by: 1) decreasing the volatility of investment portfolios, and 2) enabling investors to benefit from strategic buying and selling of investments.

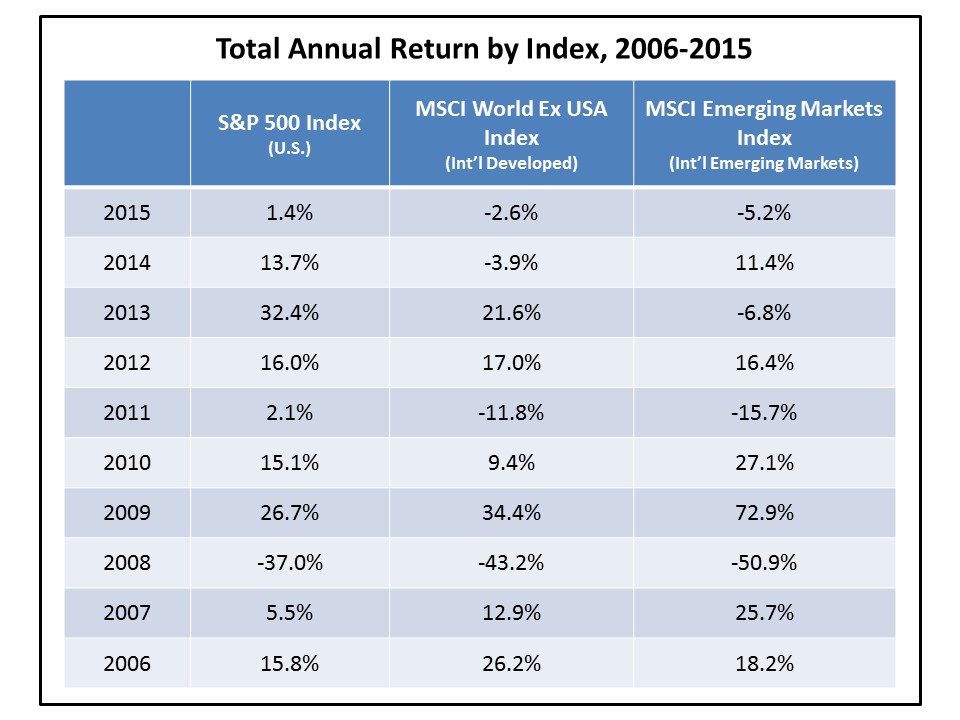

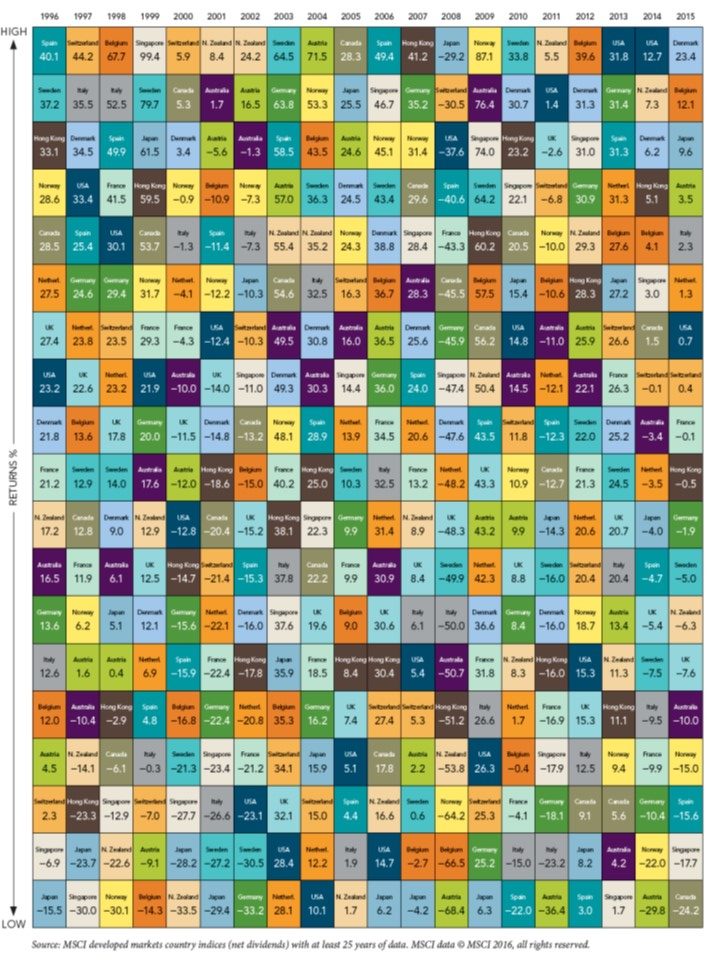

The charts to the right and below help to illustrate this point. To the right, we see that U.S. large company stocks (represented by the S&P 500 Index)  have behaved differently–sometimes better, sometimes worse–than international developed and emerging markets in aggregate over the past 10 years. The chart below illustrates how U.S. stocks (navy blue) have performed compared with stocks in other individual countries over the past 20 years. While you may have felt pretty smart if you owned only U.S. stocks over the past 5 years, what about a different 5 year period, e.g. 2002 to 2007? And can you (or anyone) say decisively how the chart will look over the next 5 years?

have behaved differently–sometimes better, sometimes worse–than international developed and emerging markets in aggregate over the past 10 years. The chart below illustrates how U.S. stocks (navy blue) have performed compared with stocks in other individual countries over the past 20 years. While you may have felt pretty smart if you owned only U.S. stocks over the past 5 years, what about a different 5 year period, e.g. 2002 to 2007? And can you (or anyone) say decisively how the chart will look over the next 5 years?

Non-U.S. stocks comprise almost half of the world equity market (in terms of market capitalization). By diversifying your portfolio to include these stocks, you decrease the volatility of your portfolio as compared with investing in only a single country or asset class. Since international markets are sometimes up when U.S. markets are down, and vice versa, international diversification leads to a smoother ride for your portfolio over the long-term. It also creates opportunities to take advantage of changes in the relative value of different asset classes over time by systematically rebalancing your portfolio (a disciplined approach to buying low and selling high) and possibly by realizing gains or losses in a strategic way to minimize capital gains tax. So, stay the course, and you will reap the benefits … eventually.

As Craig L. Israelsen recently wrote in Financial Planning magazine, “The real challenge of diversifying is being patient as we watch the various ingredients in our portfolio take their turn being the hero … and the goat.”

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870