For many young adults entering the workforce, the idea of saving for retirement— a whopping four decades away— is not very compelling. Student loan payments, car payments, eating out and entertainment expenses, travel expenses, or perhaps saving for a first home all seem to merit greater attention in the allocation of their monthly paychecks. Certainly, some of those expenses are non-negotiable, and all of them have their place. However, putting off the task of saving for retirement will only make it more difficult to reach that goal in the long run— and it doesn’t take much time in the workforce for even the most satisfied workers to realize that they don’t want to work forever. To help convince skeptical young workers of the benefits of starting to save for retirement early, we discuss some of the primary reasons for doing so below.

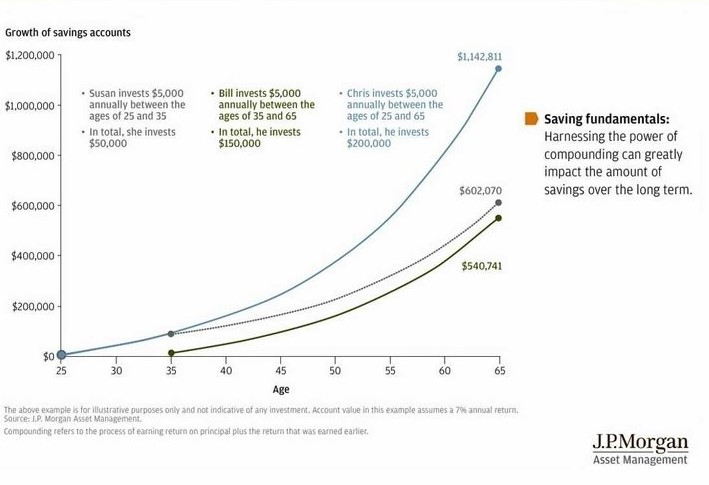

Compounding. In our post, “Top 10 Mistakes to Avoid in Saving for Retirement,” we point out that starting to save for retirement early is one of the most effective ways to avoid coming up short. The main reason for this is compounding— the fact that your investment earnings are reinvested so that you experience growth on prior earnings as well as on the principal amount invested. This chart from JP Morgan (below) illustrates the point well. If Susan invests $5,000 each year from age 25 to 35 (10 years), while Bill invests $5,000 each year from age 35 to 65 (30 years), who will have more money at age 65? As any survivor of Econ 101 can tell you, the answer is Susan, though it is a rather mind-boggling truth. If Susan and Bill’s investments average a 7 percent annual return, the fact that Susan began investing earlier matters more than the fact that Bill saved for three times as long. And, of course, if you begin saving early and save for a longer period of time, then you will be even better positioned for a comfortable retirement, like Chris in the chart below.

Company Match. If your employer offers a company match for retirement savings, that is yet another reason to start saving early. Neglecting to contribute at least enough to your retirement plan to receive the full match means you are leaving money on the table that your employer has offered to give you. Free money! Just by doing something that will benefit you anyway!

Fewer Competing Priorities. For many young professionals, it may seem impossible (and perhaps unnecessary) to take 5, 10, or 15 percent out of their paychecks for retirement contributions when they already struggle to make ends meet on their relatively low starting salaries. After all, as their careers progress, their salaries will increase, and then it will be easy to catch up on retirement savings later on, right? Not necessarily. As challenging as it may be to live on, say, $40k per year in your mid-20s, it may be even more challenging to live on $80k per year in your mid-30s if your expenses then include paying a mortgage; feeding, clothing, and educating kids; supporting a spouse who stays at home with kids or is in grad school; etc. Most young adults have fewer competing priorities for their income when they enter the workforce than they will in subsequent decades, so establishing the habit of saving for retirement and starting to build savings early will help significantly as they progress toward that goal in the decades to come.

Tax-Favored Options. Having a lower income can also be helpful in terms of the types of retirement savings available to young professionals. Contributing to a Roth IRA and making tax-deductible contributions to a traditional IRA are both subject to income limits, so those options are no longer available once your income exceeds a certain amount. For young workers without a retirement plan through their employer, these are particularly useful options. Even those contributing to an employer-sponsored plan may want to consider Roth contributions as well, depending on their tax bracket and cash flow.

Retirement might be decades away, but the benefits of starting to save for it early are very significant. Don’t miss out on the chance to get ahead of the game (like Susan), instead of spending the rest of your career trying to play catch up (like Bill). And, if you have any questions along the way, don’t hesitate to give us a call.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870