As any long-time client of PFS could hopefully tell you, we advocate holding diverse stock portfolios—including growth and value stocks, large and small company stocks, U.S. and international stocks. Holding a diversified portfolio helps lower the overall volatility of the portfolio, and it generally leads to higher investment returns over the long term. The past few years have tested some investors’ faith in the benefits of diversification across asset classes, however, since U.S. large growth companies have outperformed small, value, and international stocks. In particular, the surge in the price of tech stocks (such as Apple, Microsoft, and Amazon) has left some investors wondering whether the 100 U.S. large companies of the Nasdaq—or perhaps the 500 U.S. large companies of the S&P 500—are all they need or want in their portfolios.*

Why Bother with Small Company Stocks? The academic rationale for investing in small company stocks is two-fold. First, they do tend to be more volatile than large company stocks, so the market rewards investors with greater returns over the long run since they are taking on more risk. Second, given their size, small company stocks have greater prospects for growth. Small company stocks are often defined as those with a market capitalization (i.e. total value of their outstanding shares of stock) under $2 billion. Apple, Microsoft, and Amazon all started out as small company stocks. The magnitude of growth that those companies have experienced in the past decades cannot be replicated in the future because their value would surpass the size of the global economy. So, with a diversified portfolio of small cap stocks now, investors may benefit by holding shares of the next big thing—the Apples, Microsofts, and Amazons of the decades to come.

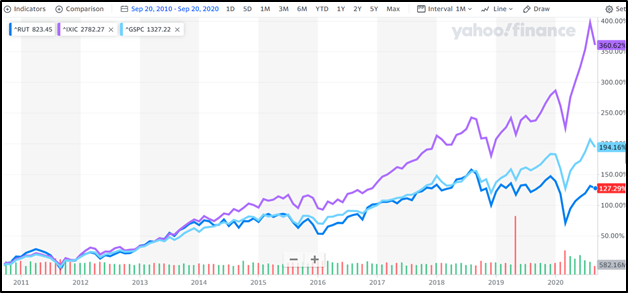

The practical rationale for investing in small company stocks is that they have higher average returns over the long-term and have performed better than large company stocks over significant periods of time. This has not been the case lately, but it remains true (even today) if you zoom out to include a longer time frame. See the charts below for a visual depiction of this trend. Chart 1 tracks the performance of the Nasdaq 100 (purple), S&P 500 (light blue), and Russell 2000 (dark blue) over the past 10 years. As mentioned above, during this time period, the U.S. large company stocks in the S&P 500—and particularly, the U.S. large company stocks in the tech-oriented Nasdaq 100—performed better than the 2,000 small and mid-size U.S. companies in the Russell 2000 index.

Chart 1: September 2010 to September 2020.

However, turning back the clock another decade, Chart 2 shows the performance of these three indices over the previous 10 years—with the small company stocks in the Russell 2000 significantly outperforming those in the S&P 500 and the Nasdaq.

Chart 2: September 2000 to September 2010.

What if you put the two time periods together? Even with the recent surge in prices for many of the tech stocks in the Nasdaq, the performance of the small company stocks in the Russell 2000 is nearly equivalent to that of the Nasdaq 100 over the 20-year time frame, and both indices outpace the S&P 500 by a significant margin, as shown in Chart 3.

Chart 3: September 2000 to September 2020.

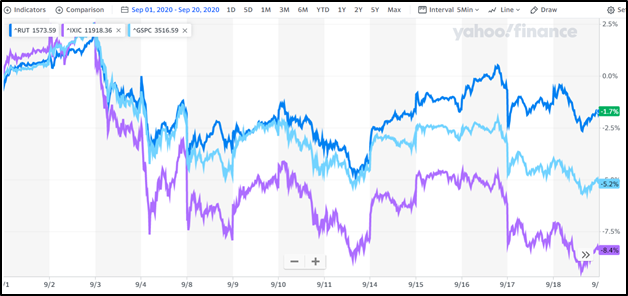

What will the future bring? At PFS, we continue to believe that small company stocks will perform well over the long term, but we will not try to outguess the market and determine exactly when their growth will accelerate beyond the recently impressive returns of U.S. large company stocks. (That type of active management typically hurts investment returns over the long term.) The first few weeks of September have been tougher on U.S. large company stocks than U.S. small company stocks, as seen in Chart 4, but it is far too easy to cherry pick different timeframes to weave different stories about what has happened, is happening, and will happen in the stock market. At PFS, we would rather assume the challenging task of remaining patient and disciplined in our investment strategy—investing in both the Davids and the Goliaths—to help our clients to be financially successful over the long term.

Chart 4: September 1, 2020 to September 20, 2020.

*As we have discussed in prior posts, media reports often refer to popular indices, such as the S&P 500 or Dow Jones Industrial Average, when discussing the performance of “the stock market,” but those indices only include a portion of the stocks that would be included in a globally-diversified stock portfolio. While those indices can serve as a helpful benchmark for discussion of returns, they represent only U.S. large company stocks and are not an accurate proxy for the performance of a well-diversified portfolio that includes stocks of large and small companies, growth and value companies, as well as U.S. and international companies.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870