Over the past decade, investors have increasingly turned to Exchange Traded Funds (ETFs) as a favorable investment vehicle when looking for diversified, low-cost, passive investment options. The ETF industry, which did not even exist 30 years ago, recently topped $5 trillion (yes, trillion!) in assets under management. Last week, Dimensional Fund Advisors (DFA), which PFS has typically used for their mutual fund investment options, launched their first two ETFs, and they are planning to release 7 more ETFs over the coming year. What are ETFs, what are their advantages as compared with mutual funds, and why is DFA moving into the ETF game now? We provide some answers to these questions below.

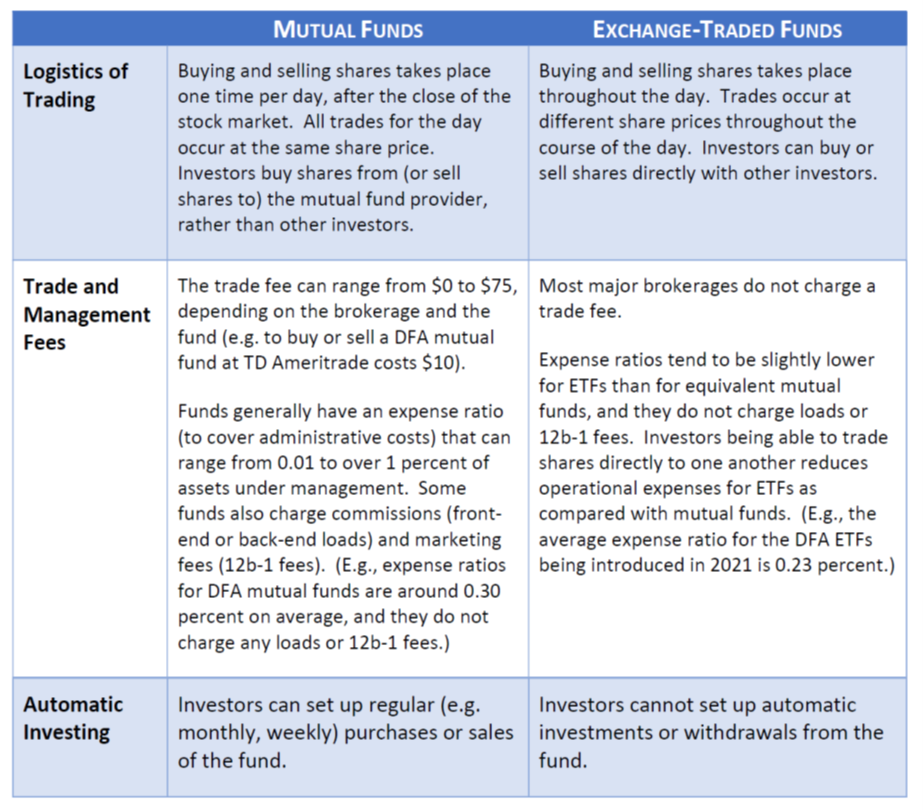

The Differences between Mutual Funds and ETFs. The core function of mutual funds and ETFs is the same—namely, to provide a diversified basket of stocks and/or bonds, so that investors can enjoy lower volatility and fewer unnecessary risks in their portfolios as compared with investing in individual stocks. Technical differences* in how shares of mutual funds and ETFs are created and redeemed, however, translate into practical differences in how investors can trade the two investment options, which in turn impacts taxes and fees.

The Pros and Cons of ETFs Versus Mutual Funds. Given the differences in how ETF shares are created and traded, ETFs have some advantages and some disadvantages as compared with mutual funds.

Pros of ETFs:

Cons of ETFs:

Why Is DFA Launching ETFs Now? After nearly 40 years in the mutual fund industry, DFA is now branching into the ETF market for two main reasons. First, there has been demand for a DFA-style ETF for many years. Financial advisors who value DFA’s investment strategy have wanted DFA products available as ETFs due to their tax-efficiency and slightly lower fees. Second, the SEC passed a key rule (Rule 6c-11) impacting the regulation of ETFs last year. The new rule enables DFA to convert its tax-managed mutual funds into ETFs (without generating capital gains for investors) and also allows DFA to continue its flexible trading strategy in an ETF structure, which has been one of the hallmarks of how DFA aims to provide an edge over index funds in terms of investment returns.

Should PFS Clients Start Using ETFs? In the past, PFS has chosen not to use ETFs in light of: 1) the inability to do automatic investing, 2) the resulting trade fees, and 3) the lack of ETF products following what we view as the optimal investment strategy. However, two out of three of these reasons have changed in the past year, so our view on ETFs is changing as well.

As mentioned above, when using ETFs, investors cannot set up monthly transfers to automatically invest or take withdrawals from the fund. This represented a major drawback since most PFS clients take advantage of this option with their mutual funds. It is possible for us to manually input small trades in or out of an ETF each month in the absence of an automatic trading option, but until the fall of 2019, this would have generated an intolerable level of trade fees for our clients. At that time, however, several major brokerages (including TD Ameritrade and Schwab) dropped their trade fees on ETFs completely. Additionally, in the past year and a half, two different companies launched ETFs that follow our preferred investment strategy—a new company called Avantis Investors and now DFA. The inability to set up automatic investments still presents a logistical challenge on our part, but the elimination of trade fees and introduction of ETFs with a compatible investment strategy has induced us to begin using ETFs in taxable accounts to some extent, and this shift will continue in the coming year, especially as DFA expands its ETF offerings.

As always, please reach out to us with any questions. We are happy to discuss ETFs in more detail and how they may add value for your portfolio in the coming years.

____________________________________

*If you’re interested in the technical differences regarding the creation and redemption of mutual fund and ETF shares… With a mutual fund, investors buy and sell shares directly from the fund provider, who in turn buys and sells the underlying securities based on inflows to or outflows from the fund. With an ETF, investors buy and sell shares directly from other investors on the secondary market. Financial institutions called “Authorized Participants” buy and sell shares of the underlying securities (i.e. stocks or bonds) to ensure that the ETF shares are trading in line with the net asset value of the underlying securities.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870