Over the past decade, an increasing number of consumers have prioritized checking their credit report and credit score on a regular basis. The three credit agencies—TransUnion, Experian, and Equifax—helped facilitate this change by establishing a program allowing consumers to check their credit reports once a week for free. According to TransUnion, 58% of consumers in the U.S. now report checking their credit at least once a month, while less than 20% of consumers checked their credit reports at least once per year as of 2014. This is a positive change, especially given that checking credit regularly can help guard against identity theft. However, for many consumers, their credit score is still a number that emerges from a mysterious black box. They are not aware of the factors that determine it and therefore how to build and maintain a high credit score.

Why Does It Matter? Credit scores matter when applying for a new job, new apartment, mortgage, car loan, student loan, credit card, or any other type of debt. A low credit score might hinder you from obtaining approval for a new job, apartment, or loan, and it can increase the cost of loans by forcing you to borrow at a higher interest rate and increasing the monthly payment on the loan. Even when you are trying to “do the right thing,” it is possible to lower your credit score if you are not aware of the factors that impact it. While most consumers know that paying bills late or maxing out available credit could hurt their credit score, some may not be aware that having too few or only recently opened credit cards could hurt their score as well. As one client recently discovered, even an attempt to simplify and closely manage your credit by having just one credit card can lead to a higher interest rate on a loan.

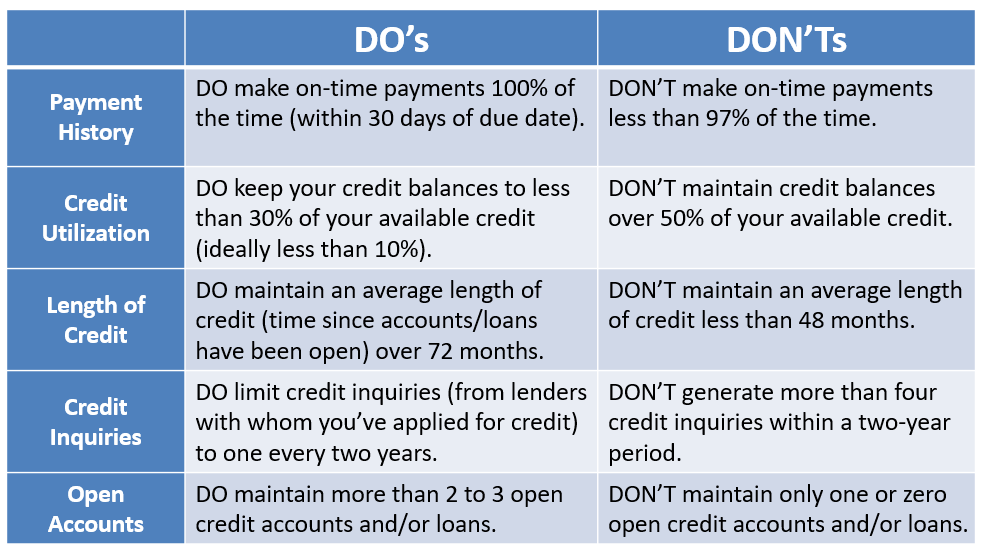

What Constitutes an Optimal Credit Profile? In determining your eligibility for a loan, lenders can use credit reports from any of the three credit agencies, which each prioritize different aspects of your profile in calculating your credit score. However, consumers should maintain a high score if they stick to the following guidelines.

One or more marks in the “DON’T” category may significantly drag down your credit score, but remember that even if you avoid the “DON’T” category, lenders may still deny you the best interest rate if your credit profile does not meet the optimal criteria listed in the “DO” column. Be vigilant about following these five guidelines, be sure to check your credit report regularly to protect against identity theft, and enjoy lower interest rates thanks to gaining some insight into that mysterious black box.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870