Last week, Virginia529 launched a new investment portfolio, which includes an innovative mix of features from the old Prepaid Tuition program and the current Invest529 program.* The new portfolio, called the Tuition Track Portfolio, allows investors to purchase “Tuition Track units” that will increase in value each year by the amount of average tuition inflation among Virginia public 4-year colleges. This could be an attractive method of saving for college expenses, particularly for two groups of investors: 1) those who want their funds to grow but have a low tolerance for investment risk, and 2) those investing for beneficiaries who are a few years away from starting college.

Key Features of the Tuition Track Portfolio. Like the other Invest portfolios at Virginia529, contributions to the Tuition Track Portfolio can be:

Unlike the other Invest portfolios, the Tuition Track Portfolio:

Over the past decade, college tuition inflation has averaged almost 5% per year. Especially in light of the current low interest rate environment, the Tuition Track Portfolio could generate higher returns than many of the other Invest529 portfolios in the coming years, particularly those that are completely (or predominantly) invested in fixed income investments (i.e. cash and bonds).

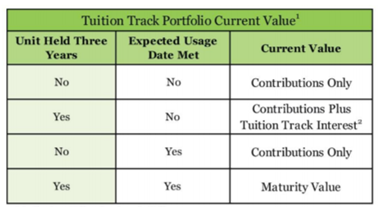

An important caveat, however, is that Tuition Track units must be held for three years and the beneficiary must reach college age before the units are credited with “Maturity Value,” which represents the increase in annual average tuition since the units were initially purchased. Otherwise, as shown in the chart to the right, if investors withdraw the funds from the Portfolio earlier, they will only be credited with their initial contributions (for units held less than three years) or their contributions plus a marginal amount of interest (for units held more than three years but the beneficiary is not yet college age).

Who Should Invest in the Tuition Track Portfolio? As any parent whose kids started college in 2001 or 2008 could tell you, it is very important to manage the extent to which your college savings are invested in the stock market (and exposed to market volatility) as your kids approach college age. This means that prudent investors will increase the amount of bonds in their college savings portfolios over time. However, as mentioned above, average tuition increases may outpace bond returns in this low interest rate environment. Therefore, investors whose kids are 3 to 5 years from starting college should consider the Tuition Track Portfolio. The Virginia529 Target Enrollment portfolios for beneficiaries age 13 and older are invested primarily (or entirely) in fixed income. Considering potential investment returns through that 13-year old’s senior year of college, the Target Enrollment portfolios are unlikely to deliver returns higher than the average annual tuition inflation in recent years. Plus, the Target Track Maturity Value is guaranteed, unlike investment returns for any of the other Invest529 portfolios.

Those whose kids are less than 3 years from starting college should only consider buying Tuition Track units if they’re planning to use them for the later years of college, given the holding requirements in the chart above. Those with younger kids (e.g. under age 13) could consider the Tuition Track Portfolio if they are risk averse and do not want their college savings to be subject to market volatility. Depending on market performance and the timing of contributions, withdrawals, and changes in investment allocations, there is certainly a chance of obtaining better investment returns with the Tuition Track Portfolio than the Target Enrollment or other Invest529 portfolios, even over a longer timeframe. Based on long-term averages though, it would be advantageous for parents of younger children to invest in a portfolio with stock market exposure instead.

If you have questions about the Tuition Track Portfolio, investing in 529 accounts, or saving for college in general, please don’t hesitate to call or email our office. We’re here to help!

*For those unfamiliar with 529 plans, they are tax-advantaged savings plans designed to help pay for education (generally for higher education expenses, but Congress allowed limited use of 529s for K-12 education as well starting in 2018). The funds in 529 plans can grow and be withdrawn tax-free, provided they are used for qualified education expenses. Many states also offer state tax benefits for contributing to 529 accounts.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870